Forum editorial: Minn. tax on tobacco is a health tax

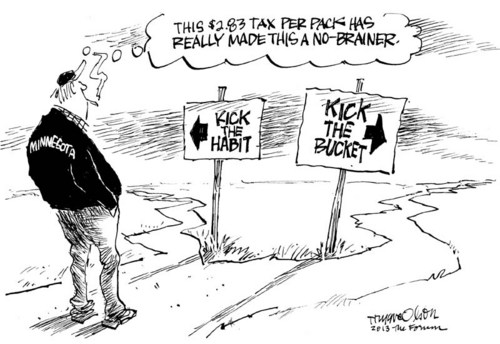

Opponents of Minnesota’s new tobacco tax seem to believe the $2.83 per pack of cigarettes tax is about only revenue and business. It’s not. It’s first and foremost about public health.

While the tax has had expected impacts on revenue and business since it went into effect July 1, its primary purpose is to discourage smoking. The tax is having the predicted results: Sales of cigarettes are down. Early evidence suggests the steep rise in the tax will generate a corresponding decline in smoking. That has been the experience of every other state that raised its cigarette tax substantially. Young smokers or potential smokers are especially sensitive to price.

Even as sales of cigarettes slipped as the tax took hold, revenue increased, as forecast. The tax is up 30 percent, after all. Some of that additional revenue will be used to fund the new Vikings stadium.

However, as fewer Minnesotans take up the habit and others quit or reduce cigarette purchases, revenue will decline. The ideal situation, of course, would be that tobacco use falls so far as to make revenue from the tax unimportant to the state’s overall financial picture.

Reacting to the decline in sales, one person at a retail store said: “It’s very bad.” No, it’s not. In the long term, fewer people smoking cigarettes is a good thing. It’s good for their health, their medical bills and the nation’s health care system.

Often characterized as “sin taxes,” taxes on cigarettes and other tobacco products are in effect health taxes. There is no sin in public policy that aims to improve and protect health. The real sin is peddling a product that sickens and kills people.

Forum editorials represent the opinion of Forum management and the newspaper’s Editorial Board.

http://www.inforum.com/event/article/id/414349/